APRIL 23, 2024

15 min read

The field of finance has undergone significant changes over the past few years and reshaped the way businesses propose financial services to customers. Gone are the days when traditional banking services were the only option. Today digital solutions streamline financial operations and enhance customer experience.

Fintech growth became the main driver of finance transformation. The combination of technology and finance produces innovative solutions to transfer, deposit, or exchange funds. Fintech startups and enterprises leverage the latest technologies to meet customer demands and stay competitive in the fintech market.

As we look ahead to 2024, the fintech sector shows no signs to slow down. We expect to see further development of established fintech products and services. Additionally, we will see the emergence of new fintech trends both in the financial technology and regulation sectors.

For businesses considering to implement fintech products it is crucial to stay ahead with fintech industry trends. Such trend awareness will help easily navigate the fintech landscape and make an informed decision about how to develop a competitive fintech software solution.

Fintech Trends to Watch Out For in 2024

In 2024, the fintech market size will exceed $340 bn, and by 2032, this figure will increase almost fourfold and reach $1,152 bn. Such rapid growth will provide a staggering compound annual growth rate (CAGR) of 16.5% and will push the rise of new fintech sectors and banking services.

Despite the fact that the fintech market is growing, investments in fintech have dropped significantly compared to previous years. For example, in 2021, investments in fintech amounted to almost $226bn and in 2023, they reached $113,7bn.

This situation indicates that investors are becoming mWith all the decentralization and autonomy of fintech products, we are currently observing a parallel fintech trend - increasing cooperation between fintech companies and

ore selective when choosing fintech projects. Only companies that develop competitive and in-demand solutions can count on attracting funds from interested investors. That is why it is crucial to be aware of and come along with fintech industry trends.

Growing Adoption of Embedded Finance

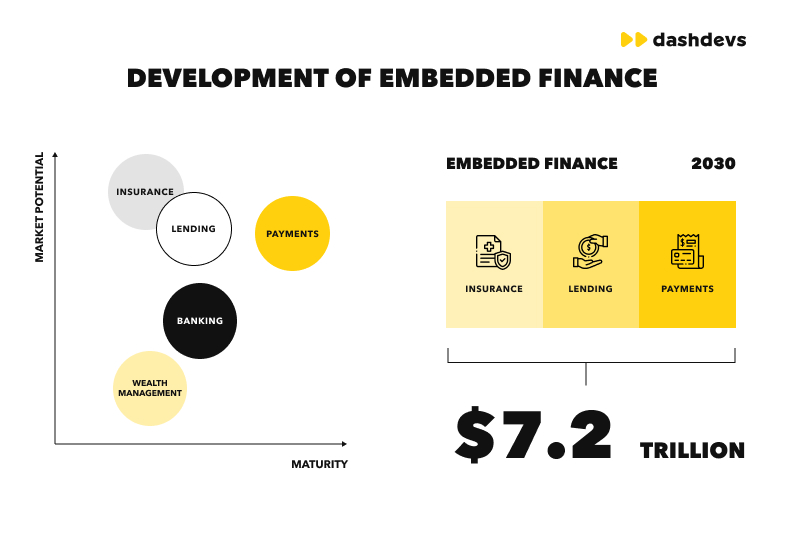

Embedded finance is the integration of a financial service into a non-financial business. The development of embedded finance will empower non-finance companies to handle monetary operations on their sides.

Today, embedded finance is one of the fast-growing and latest fintech trends. According to Dealroom, the embedded finance market will reach 7.2 trillion by 2030.

The majority of modern businesses that sell products or services use embedded finance to streamline customer experience.

Examples of embedded finance are payments on streaming platforms like Netflix or Spotify, in online games, Roblox or Genshin Impact, and on online learning platforms, like Coursera or Udemy.

Embedded payments are actively used by non-financial services, but they are not the only form of embedded finance. Other rapidly developing embedded finance services are insurance, lending, banking, and wealth management.

Remember, for example, that many e-commerce sites offer to purchase in instalments or that ticket booking platforms allow you to buy travel insurance directly on their site. In this case, lending and insurance services are embedded into non-lending and non-insurance platforms, respectively.

Businesses looking to stay competitive in 2024 should easily navigate the embedded fintech market and provide services anticipated by customers. By offering up-to-date embedded finance services, businesses can expect a large influx of clients and high return of investment (ROI).

Intelligent Management of Personal Finance

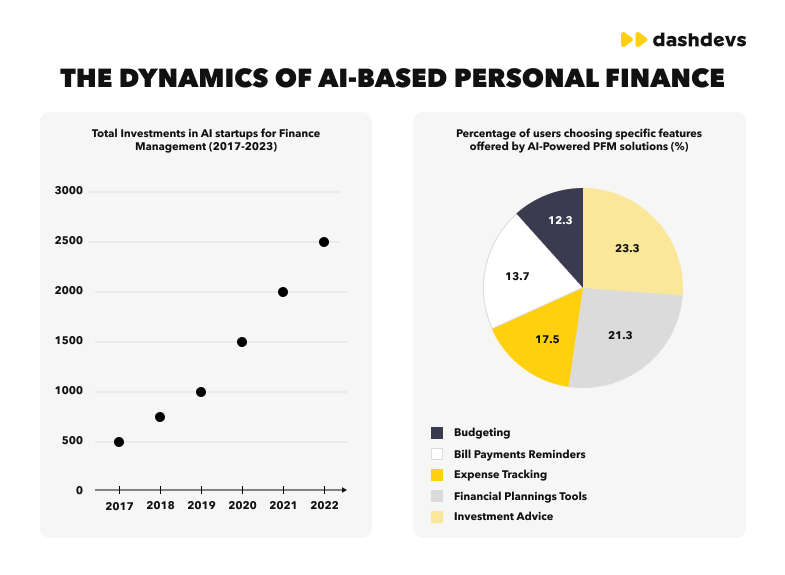

Investments in AI-powered fintech startups are growing steadily. In 2017, they were at the level of $500 million and in 2023, they reached $2,500 million. This leads to the emergence of different types of AI-powered financial applications and increasing competition in the market.

Management of personal finance is the process of making personal financial decisions aimed at changing personal financial status.

The fintech industry overview shows that delegating finance decision-making to artificial intelligence will gain momentum in 2024. According to Forbes, 59% of users trust AI-based services when making investment decisions. Only one in seven respondents distrust these services.

AI money management apps like Cleo, Eva Money, and Wizely become increasingly popular among users because they provide valuable advice that simplify finance management.

The following use-cases of AI in personal finance will be the most in-demand in the present and upcoming years. Fintech businesses can find plenty of opportunities for business growth in these niches:

Budgeting. AI-based budgeting tools analyze the user’s income and spending patterns to suggest the ways of planning the budget wisely. These tools can help create a realistic budget, considering the customer’s preferences, predicted price changes, and the overall market and fintech trends.

Expense tracking. These tools help users categorize their spendings and gain insights of where they spend the most. They may point out expense items that can be reduced or recommend ways to make them less influential on the entire budget.

Investment advice. AI can act as an expert advisor when it comes to investment activities. Users can use AI to analyze areas for investment, define the appropriate investment amount, and forecast potential returns.

Bill payment reminders. These software solutions aggregate bill payment data, including utilities, rent, subscriptions, loans, and more. They alert in advance about upcoming payments and help avoid fines and penalties.

Financial planning. AI-based software helps users plan their finances for short-term and long-term periods. Users can ask for financial advice based on a specific situation, for example, how to plan my budget if I move to another country in a month.

Below, you can see the dynamics of AI-based personal finance and the most promising AI-based finance use cases to consider for your startup.

Rise of Central Bank Digital Currencies (CBDCs)

The emergence of CBDC creates new realities for fintech businesses. They enable new use cases for fintech products and open up new regions where fintech services can be promoted. Businesses should watch the development of CBDC in 2024 and adapt their unique value proposition to customers under its influence.

Central Bank Digital Currencies are digital currencies controlled by central banks of specific countries. They are analogous to regular currencies and serve as a legal means of payment, but in electronic form.

CBDCs can be used to make payments, make P2P transfers, invest in securities, and make other monetary transactions.

Additionally, with the correct implementation of CBDC, it will no longer be necessary to collect documents to prove the source of funds’ origin.

Companies in the financial services industry should consider CBDCs as one of the biggest fintech trends in 2024. Particularly, they should monitor the regions where this trend is developing and adapt their services accordingly.

Today, more than 130 countries are planning to develop their own digital currencies. The USA, UK, Australia, New Zealand, France, Switzerland, Ukraine, and other countries are among those who are on the path to digitalization of their currencies

Moreover, there are 13 cross-border wholesale projects that aim to streamline international trade. Fintech trends 2024 suggest that we will see more of these projects in the coming years. Fintech companies should monitor these developments and implement innovative solutions to streamline international trade.

You can explore more about CBCD state and how it will shape the fintech landscape in 2024 on the graph below.

Businesses should also understand the difference between CBDCs and mobile money in order to properly plan their fintech projects and create targeted products for specific audiences.

While mobile money is mobile payments based on mobile operator accounts and accessible from subscribers’ mobile phones, CBDCs are digital currencies issued and regulated by a country’s central bank, representing a digital form of a nation’s fiat currency. Unlike mobile money, CBDCs are backed by a central authority and are not tied to a specific mobile operator or network.

For fintechs leveraging the CBDC fintech trend the promising areas of development are cross-border payments, government disbursements, and financial inclusion.

For fintechs leveraging the Mobile Money fintech trend the promising areas of development are peer-to-peer transfers, bill digital payments, and remittances.

Emergence of New Open Banking Products

In 2024, open banking enables new cooperation forms between banking and non-banking organizations and stands behind development of advanced fintech products.

Open banking allows banks and other financial institutions to securely share customer data (after their consent) through APIs.

The concept of open banking is not new. It was first officially regulated in 2015 by the Payment Service Directive (PSD) 2 in Europe. Now, it is actively developing and regulated in countries worldwide.

The technological advancements of 2024 and the appearance of PSD3 create new trends and products in the fintech banking industry.

Here are the innovative fintech solutions appearing in 2024 thanks to open baking:

Account aggregators - gather all user’s financial accounts in one place. Account aggregators collect all the customer’s financial data and present it to a bank or personal finance platform, for example, Mint.com. This gives a customer a comprehensive view of their financial well-being. Yodlee and Plaid are some of the most popular account aggregators.

Non-banking card issuers - provide services of payment card issuance similar to traditional banks despite not being one. Non-bank card issuers can be fintech companies, like Stripe or Square, retailers, like Amazon or Macy’s, payment service providers, like Paysafe or Adyen, or digital-only banks, like Revolut or N26.

Real-time fraud detection solutions - offer advanced analytics tools and machine learning (ML) algorithms to analyze banking transactions in real time. Thanks to open banking, such software programs instantly access the transactional data and immediately alert users if malicious activity is detected. Cifas and Feedzai are examples of fraud-detection solutions.

Instant loans and credit scoring - quickly formulate the customer’s credit score in response to a loan request. Open banking allows easy access to a customer’s credit history and past loans. Businesses can use the credit scoring services to approve or decline a customer’s loan request. Upstart and C3 AI are the credit scoring platforms that streamline the lending process.

The open banking market is projected to reach $11.7 bn in 2027, which is double the $5.5 bn in 2023.

At the same time, the number of open banking calls will increase more than fivefold, reaching 580 in 2027 compared to 102 in 2023.

Reincarnation of Decentralized Finance (DeFi)

After a significant decline in investments in decentralized finance in 2023, we expect to see growth in DeFi funding in 2024. Fintech companies should seize this opportunity to develop and implement innovative DeFi products. This will allow them to diversify product offerings, attract a broader user base, and tap into new revenue streams.

DeFI, or decentralized finance, is an alternative model of organizing finance operations without intermediaries. Transactions occur automatically using smart contracts, which are created based on distributed registry technology. Users control their assets on their own with no regulation outside.

Until recently, DeFi was considered a new technology with many businesses and customers being skeptical about using it. However, in 2024 DeFi will turn into one of the most significant fintech industry trends. More and more users trust decentralized platforms due to the transparency of transactions and the independence of a central authority.

In April, 2024, the total value locked in DeFi platforms was accounted for $86.8 bn. It should be noted that this is almost two times less than the same figure in 2022 when interest in DeFI was at a high level. At that time, DeFi platforms offered significantly higher yields compared to traditional finance. They also had lower entry barriers compared to traditional finance. Additionally, increased media coverage turned DeFi to the mainstream, and this encouraged more users to invest in decentralized finance.

Nevertheless, in 2024 we see a significant increase in Defi transactions compared to 2023, when the level of decentralized operations dropped significantly and did not rise above $52 bn.

The current investment landscape offers a prime opportunity to jump on the fast-moving DeFi fintech trend. Fintech businesses should consider developing products such as decentralized lending platforms, yield farming protocols, or decentralized exchanges.

Regulatory Compliance Trends in Fintech Industry 2024

Fintech industry growth is characterized not only by the emergence of new fintech products but also by easier access to personal data and bigger impact on financial decision-making. On top of that, that rise accelerated the development of new cybersecurity threats. As technologies advance, the skills of cybercriminals also evolve. Attacks become more sophisticated and tech-savvy. Given this, it is crucial that fintech companies comply with all security standards mandated by relevant regulations.

Regulatory compliance documents like General Data Protection Regulation (GDPR) and PSD2 list clear requirements for companies working with users’ payment data. But in addition to these regulations, we will see new regulatory standards for fintech in 2024. Here is what fintech companies across domains should pay attention to.

The AI Act

The countries of the European Union have developed a draft of the AI Act to regulate the activities of companies that use artificial intelligence. The act is expected to enter into force in 2025.

The document lists specific areas where it is prohibited to use AI. Among other things these are social scoring, biometric categorisation, crime risk assessment, and more.

AI-allowed business areas are divided into three risk zones: high, limited and minimal. For each risk zone, the Act defines specific requirements for how artificial intelligence should be used.

Fintech companies must choose their risk zone depending on the nature of their activities.

Fintech companies falling under the high risk zone must:

- Develop a risk management system to minimize issues associated with their AI-based fintech platform

- Undertake data governance to ensure that datasets are relevant, unbiased, and error-free

- Develop technical documentation on how to use AI fintech product

- Keep records associated with AI software operation

- Enable human supervision under the AI-based fintech software

- Implement robust cybersecurity measures

- Follow best practices of quality assurance

PSD3

The final version of PSD3 is expected to be ready by 2024 with companies having up to 18 months to adopt its regulations. It will aim to strengthen consumer rights and introduce substantial changes to fintech business regulations. Among other requirements, fintech companies will have to:

- Implement a more reliable client authentication system

- Strengthen anti-fraud measures, focusing on anti-spoofing

- Enhance transparency and data protection standards

- Provide clearer and more accessible terms and conditions for users

- Ensure compliance with stricter reporting and disclosure requirements

You can read more about PSD3 and how it differs from PSD2 in another article by DashDevs.

Fair Lending Act

With all the decentralization and autonomy of fintech products, we are currently observing a parallel fintech trend - increasing cooperation between fintech companies and traditional financial institutions. This is caused primarily by the development of open banking and, as a result, the growth of bank-like products offered by non-banking companies.

Lending is one of the most common such products. Today, fintech companies actively offer services such as Buy Now Pay Later, as well as personal loans, student loans, car loans, etc.

The Fair Lending Act regulates the lending operations of both banking and non-banking organizations. Its main goal is to avoid bias in the provision of credit on sexual, racial or religious grounds.

Fintech companies will have to take into account the guidelines provided in the Act and put the interests and rights of users as a priority when deciding to issue a loan.

Decentralized Finance Regulation

The future of fintech is closely tied with decentralized finance, which develops separately from the central financial authority, the central bank. The self-regulating nature of decentralized finance separates DeFi companies from the impact of specific regulations. This primarily concerns national currency regulations and buy-sell transactions using national and foreign currencies.

Nevertheless, DeFi companies, like any other business, must operate within the legal framework. In 2024, the regulatory landscape for such companies will become more extensive, detailed, and country-specific.

Considering the variety of acts and laws, it can be challenging to navigate the regulatory fintech landscape.

First of all, DeFi companies must understand what regulations they fall under. This is mainly determined by the nature of the business activity and the region where they operate.

Below is a list of the most common regulations that DeFi businesses should take into account:

| What is regulated | Regulation in the USA | Regulation in the EU |

|---|---|---|

| DeFi tokens classified as securities, crypto-assets trading | Securities and Exchange Commission (SEC) | Markets in Financial Instruments Directive (MiFID), Prospectus Regulation |

| Anti-Money Laundering (AML) | Financial Crimes Enforcement Network (FinCEN),Bank Secrecy Act | 5th and 6th Anti-Money Laundering Directive (AMLD) |

| Smart contracts and electronic signatures | Uniform Commercial Code (UCC) | Electronic Identification, Authentication and Trust Services (eIDAS) |

| Taxation of virtual currencies | Internal Revenue Service (IRS) Guidance on virtual currencies | Value Added Tax (VAT) and income tax regulations |

How Fintech Development Provider Can Help You Keep Up With Fintech Trends in 2024

The fintech outlook for 2024 is characterized by the development of advanced technologies, strict security requirements, and the emergence of new regulatory forms in the fintech industry.

New and existing fintech companies need to stay up to date with the latest innovations and market trends. To shape the future of fintech, they must implement high-tech solutions and act in accordance with existing regulations.

Often, owners do not have enough time and resources to explore the latest fintech trends and choose the right development strategy. In this case, specialized fintech development companies can provide expert assistance by taking on the technical and legal aspects of project implementation.

By partnering with a fintech development provider you can be sure your product goes hand in hand with the latest fintech trends. You can also delegate research, development, and compliance activities to a software development provider. Here’s what you can count on when working with a reputable fintech vendor:

Access to specialized fintech expertise. The fintech development provider has a proven track record of completed fintech projects. It has in-depth knowledge of actual fintech trends and technologies, including programming languages, frameworks, cloud services, and third-party integrations. By partnering with a fintech development provider, you do not need to invest time in market research, development plan creation, and tech stack selection. The development provider will be able to quickly advise the right technologies and development approaches as soon as they study your business goals and budget.

Accelerated time to market. With a fintech development provider, you can quickly achieve the desired result and enter the market with a finished product. The key is that specialized development companies often have ready-made backend solutions that can be easily adapted to the client’s needs. Such solutions allow you to create a fintech product quickly using a ready-made codebase and frameworks. At the same time, you can maintain a high level of uniqueness for your software solution, just like during custom software development.

FintechCore by DashDevs is one such solution that enables fintech businesses to accelerate the development of digital banking. By using FintechCore, you can create unique software under your own brand more affordably and faster than when using custom software development

Control over the development process. Partnering with a fintech development provider does not detract your participation in the fintech project. You can actively participate in development, communicate with the team, and adjust the prioritization of tasks depending on changing business circumstances. The development provider will keep you updated on the development process and inform you of any obstacles it encounters. At the same time, if you wish, you can also delegate the management function to the development provider. You decide how actively you want to participate in the development and what level of knowledge about the details of the project is acceptable to you.

Today, many software development companies offer services for the development of fintech software. For businesses that want to create a product in accordance with fintech trends, it is important to choose a reliable partner with proven experience and an excellent reputation.

At DashDevs, we have deep expertise in developing fintech products for SMBs and enterprises. Our portfolio includes digital banking solutions, payment apps, trading platforms, fintech integrations, and more.

Some of the recent fintech project we developed are:

- MuchBetter, an award-winning e-wallet preferred by global gaming sites

- Downing, a sustainable investment management platform focused on renewable energy

- Chip, an AI-based app that helps customers manage their savings and investments

- Tarabut, an open-banking app that connects banks and fintechs in MENA region

- Aspiration, an innovative fintech app helping customer track their financial footprint

If you are looking for a reliable technology partner to create a competitive fintech solution, don’t hesitate to contact us. We will study your project and advise on how to implement it in the most efficient way.