Are you starting your own fintech business in the UK but getting tangled in the web of ever-changing rules and regulations? It’s always a dark forest for everyone who wants to step into this field, and I’m her...

Fintech consulting services

Book a consultation

fintech consulting That

Addresses Your Every Concern

With our finger on the pulse of the latest fintech trends and a deep understanding of the industry's nuances, we are equipped to help your company not only meet but exceed its potential. Trust us to be the partner that understands your concerns and delivers the clarity and direction you need to thrive.

people often ask us

How to build a bank from scratch?

Steps to start a fintech company?

What should we avoid in international expansion?

How to integrate with vendors right?

Is our platform regulatory compliant?

What are our key cybersecurity risks?

How do we secure Series A funding effectively?

What tech stack balances cost and scalability?

Can we smoothly incorporate blockchain?

How can we deploy features more quickly?

How to check developers' work thoroughly?

What’s the best go-to-market strategy for a fintech platform like ours?

Fintech Consulting is

Essential in These Key Scenarios

First product launch

We pride ourselves on having successfully launched 100+ new fintech products. Our comprehensive support in market analysis and product positioning ensures that each launch makes a significant market impact with go-to-market strategies tailored for success.

Business scaling

Our expertise in scaling has been instrumental in growing businesses globally. We've developed scalable models for over 200+ companies, ensuring their infrastructure and resources are perfectly aligned to meet customer needs and support sustainable expansion in 40+ countries.

Market expansion

Our experience in market expansion is vast, with our clients successfully operating in over 40+ countries. We provide valuable insights into local regulations and strategies, assisting businesses in navigating the complexities of entering and thriving in new markets.

New investment round

With our guidance, clients have successfully raised 100M+ investments. We refine business plans and enhance pitches, advising on strategies that effectively attract and secure crucial funding for continued innovation and growth.

Business Process Analysis

Our proven track record includes enhancing operational efficiency for numerous clients. We've identified and rectified inefficiencies in over 150+ businesses, delivering new solutions that are streamlined and optimized for immediate impact and long-term success.

Software modernization

In our commitment to keeping fintech solutions cutting-edge, we've guided over 120+ fintech companies through successful software modernization projects. Our focus ensures their technology stack is continually updated, secure, and capable of meeting evolving market and customer needs.

Our clients

Trusted by leading innovators worldwide

Fintech consulting

services we provide

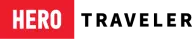

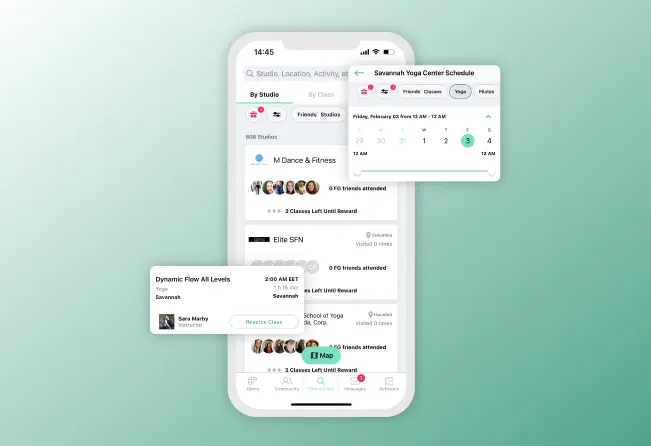

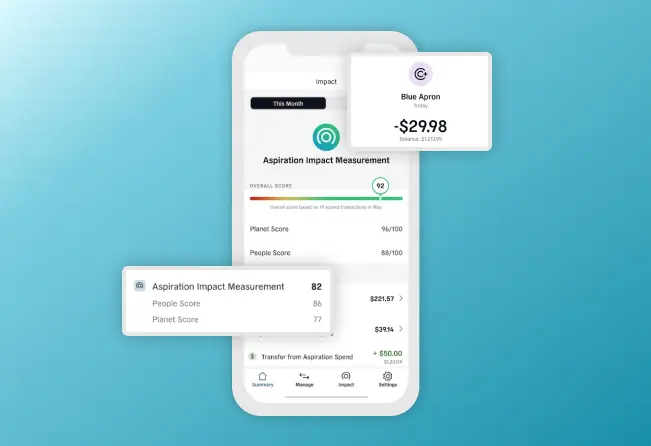

banking solutions

DashDevs has extensive experience in creating foundational systems for smart process management. Since our team has created more than 10 banking apps, we can now assist you in resolving mobile banking app challenges and developing solutions to construct a neobank from scratch.

Card issuing

Our consultancy specializes in guiding you through the process of issuing, managing, and overseeing debit or credit cards effectively. We possess extensive experience in providing strategic advice for integrations with renowned providers such as Marqeta, SynapseFI, Galileo, Thredd, and more.

Regulation consulting

Navigating the complex world of financial regulations, we provide comprehensive consulting to ensure fintech solutions are fully compliant. This includes keeping abreast of local and international financial laws, a major challenge for fintech startups, and implementing practices that minimize risk.

KYC/KYB/AML

Use our extensive knowledge and tried-and-true technologies to avoid fraudulent actions. DashDevs offers a comprehensive set of consulting for financial services to help you set up, choose a vendor for your business, progress your document validity checks, screen users across national databases, and execute additional tests.

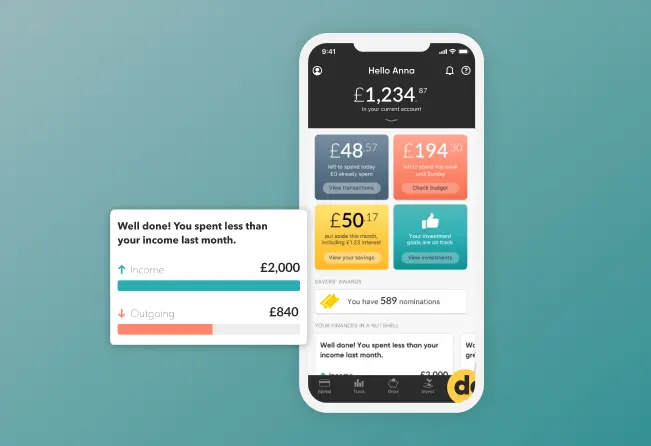

cross-border payment solutions

Our financial consulting agency enables you to enhance the possibilities of your financial software solutions using several international payment types such as SWIFT, IBAN, SEPA, and others.

Open banking

Focusing on the seamless integration with open banking APIs, we help fintech companies overcome regulatory and technical challenges, ensuring seamless connectivity and compliance with evolving financial standards.

Digital wallet

We provide advisory services for digital wallet services, addressing key concerns of security, transaction efficiency, and regulatory compliance. Our approach involves implementing cutting-edge security measures and efficient transaction processing.

Digital transformation

Guiding fintech companies through digital transformation, we address the hurdles of adopting modern technologies and digital-first strategies. These services are crucial for traditional financial institutions looking to modernize, helping them stay competitive, meet modern customer demands, and leverage digital technologies.

Digital bank

Our expertise in building new banking technologies encompasses user engagement, seamless integration, and regulatory compliance. We assist fintech leaders in creating platforms that are not only technologically advanced but also deeply attuned to user needs and expectations.

API and integrations

Our API development and integration consultancy focuses on creating a cohesive fintech industry. We help enterprises and small companies overcome the challenge of integrating various financial services and software platforms, ensuring interoperability, enhanced user experience, and streamlined operations.

White label solution

Recognizing the importance of rapid deployment in the fintech industry, our white label solution provides a balance between speed-to-market and brand-specific customization. We assist in launching branded financial services quickly and efficiently, without the resource-intensive process of in-house development.

Artificial Intelligence integration

Artificial Intelligence integration is a pivotal area for fintech companies, enhancing customer service, risk management, and operational efficiency. We help in implementing Artificial Intelligence solutions tailored to specific business needs.

Technology selection and advisory

Choosing the right technology stack is a critical decision for fintech companies. We offer advisory services that ensure the selection of technologies not only meets current business objectives but also accommodates future growth and advancements.

Software architecture review

Providing thorough reviews of fintech software architecture, we address critical aspects such as scalability, security, and regulatory compliance. Our services ensure that the software infrastructure is not only robust and capable of handling current demands but is also future-proofed against technological shifts and market innovation changes.

general ledger system

DashDevs provides industry experience and practical abilities to assist you in setting up the system to handle all settlements and payouts, maintain track of account balances, and allow treasurers to complete checkout and reconciliation operations.

Benefits of DashDevs'

Outsourced IT Services

Seasoned experts with 20+ years of experience

Our experts have honed their skills over the years, gathering knowledge and insights that directly benefit our clients.

hands-on experience of launching 100+ products

This track record demonstrates our ability to navigate the complexities of the fintech industry and deliver results that resonate with market needs.

extensive Expertise in Regulatory Compliance

With a deep understanding of the fintech regulatory landscape, our development team has navigated the complexities of compliance for numerous projects.

Proactive Approach to Innovation and Emerging Trends

Our proactive approach is reflected in our strategies, ensuring that our clients are always at the forefront of technological and market advancements.

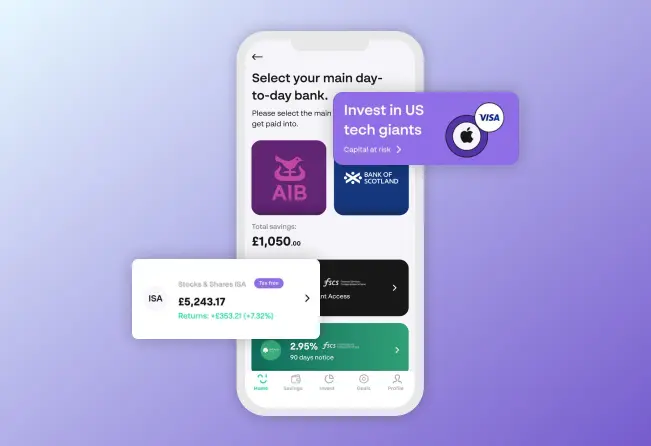

Pi-1 app is a neobank that sets to transform the global financial industry and make financial services transparent and affordable to everyone. It comes with a full line of banking products and services to help every individual: invest, manage, spend, and earn more efficiently and wisely.

5.0

From the very early days I was struck by DashDevs pragmatic approach of balancing between development and business needs. It’s really rare to find a company that not only does tech for the sake of tech, but takes grounded decisions taking into account business considerations. We built together a pretty complicated platform with 40 vendors in less than 18 month.

Aritra Chakravarty

CEO and founder Pi-1 Linkedin

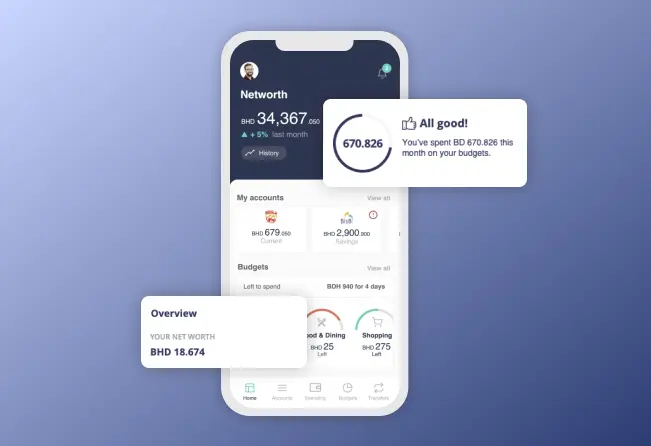

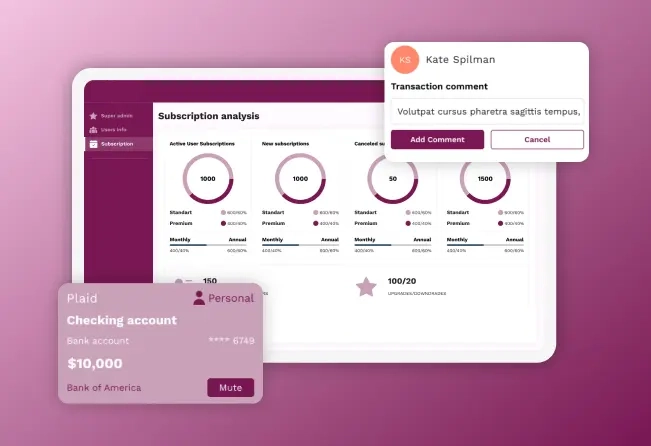

Personal Financial Manager system for the GCC region. The system provides users with the ability to access and manage bank accounts from all open-banking integrated commercial banks as well as make payments and transfers through the Open Banking platform 24/7 using a mobile application.

MuchBetter is a revolutionary award-winning payment app. Industry-leading e-wallet lets store, send and receive money securely and quickly. It is the preferred payment app of global gaming sites, providing an alternative to wallets like Neteller, Skrill, Entropay and Ecopayz.

Israel Rosenthal

CEO MuchBetter5.0

DashDevs has shown profound expertise in the field through their workers. Their outstaffing services proved a great tool for quick team augmentation. Each detail was handled precisely and professionally, enabling us to stay focused on other things.

Israel Rosenthal

CEO MuchBetter

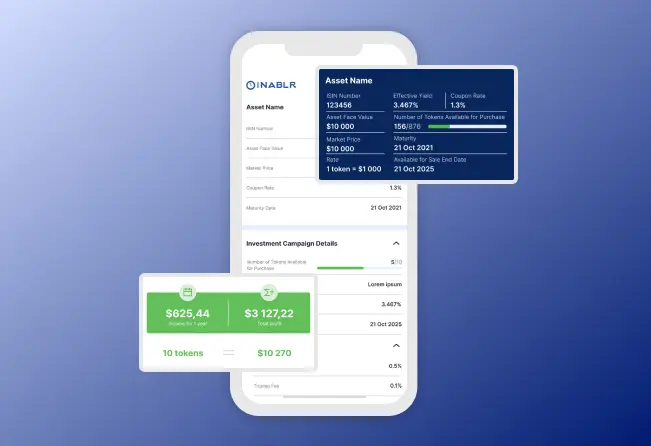

Unique platform that allows to split large sovereign bonds into smaller units in order to lower the starting investment amount. Thus, INABLR enables individual investors to come into sovereign bond market, which is hardly achievable otherwise.

Anver Jalaldeen

CEO Inablr5.0

Our stakeholders and investors are fully satisfied with the platform DashDevs has built for us. The team was incredibly attentive to our expectations and requirements, which resulted in a completely functioning product ready for any market challenge.

Anver Jalaldeen

CEO InablrFeatured resources

IT Outsourcing — FAQ

To begin working with our fintech consulting company, reach out to us to schedule an initial consultation. During this session, we will discuss your company’s specific needs, challenges, and objectives. We will provide an overview of how our services can add value to your business, outline a potential strategy tailored to your requirements and customer needs, and explain the next steps in our consulting process. Our goal is to establish a clear understanding of your vision and how we can work together to achieve your fintech innovation.

Our experts have honed their skills over the years, a wealth of knowledge and insights that directly benefit our clients.